How to Apply for an Ehsaas Naujawan Interest-Free Loan through Bank of Khyber and Get Accepted for Bok Loans

Have business ideas but you are short on funds to start the business? The government of KP has sorted a solution to your problem and this article will explain how to apply for Bok Loan.

The Government of Khyber Pakhtunkhwa has launched Ehsaas Naujawan Programme under which they will provide interest-free loans to empower young entrepreneurs. This will help them launch or expand businesses in various sectors. The funding is divided into two components. One is by the Bank of Khyber (BoK) and the other is by Akhuwat (AIM). You can read their detailed criterias by clicking on their names.

How to Apply for Bok Loan?

Here’s a step-by-step guide on how to apply for the Ehsaas Naujawan Loan through Bank of Khyber called BoK loan. BoK loan is applied online and there is a dedicated portal for the applications. Read the full article to go through their dedicated portal, eligibility criteria, and what to expect during the application process.

Step 1: Check Your Eligibility

Before applying, ensure that you meet the following eligibility criteria for the Ehsaas Naujawan Programme:

- You should be a Permanent resident of Khyber Pakhtunkhwa or merged districts.

- You should be aged between 18-35 years.

- You should possess a valid CNIC (Computerized National Identity Card).

- You should have a registered business entity with a minimum of 3 partners or the maximum of 5 directors, or a viable business idea with growth potential.

- Applicants must not have any outstanding loans in default and should have a clean record in the e-CIB report.

- The business must have job-creation potential and be in an eligible sector such as IT, retail, manufacturing, tourism, healthcare, or agriculture.

Note

Businesses involved in restricted areas (like arms and ammunition, alcohol, etc.) are not eligible. How to Apply, Keep reading this article:

Step 2: Register and Apply Online on BoK’s Portal

Visit the Bank of Khyber’s online application portal specifically designed for the Ehsaas Naujawan Programme.

Here, you’ll need to provide details about your business, partners, and submit your proposal. Here’s what the application form includes:

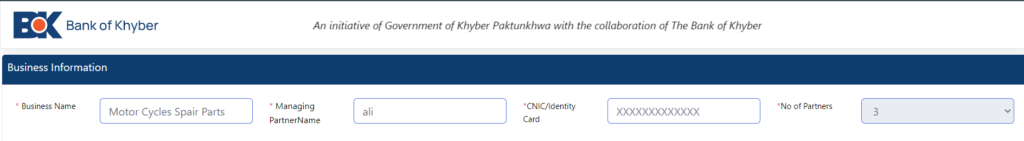

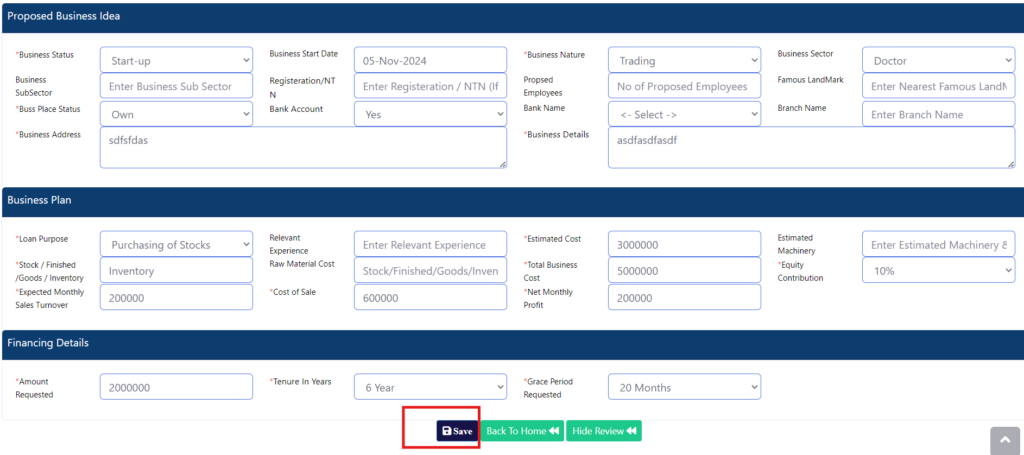

- Business Information

- Here you will have to provide Business Name and Legal Status (registered firm/partnership).

- Then you will have to enter the Managing partner name and then CNIC no.

- Information on the Business Sector and Potential Employment it can generate.

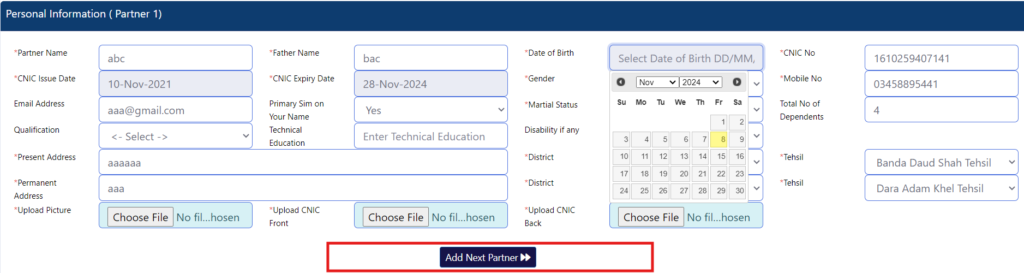

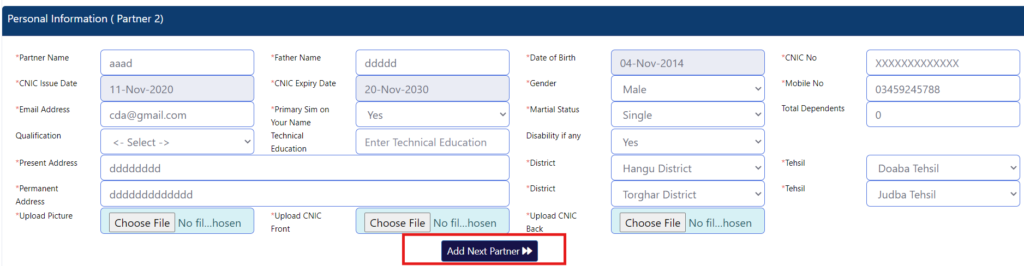

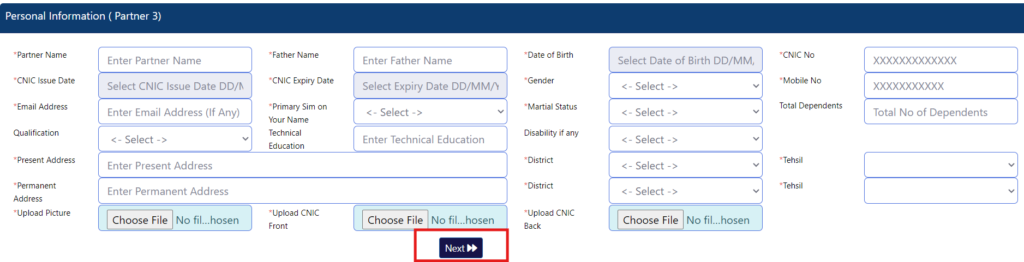

- Partner Details: List the details of 3 to 5 partners involved in the business. All partners must be committed to utilizing and repaying the loan responsibly.

- Business Proposal: Upload a clear, feasible business plan. The plan should outline the potential and growth projections of your business, supported by market research and evidence of profitability.

Tip

Focus on creating a sustainable business plan that shows economic viability and aligns with your team’s skills.

Here, you’ll need to provide details about your business, partners, and submit your proposal. Here’s what the application form includes:

Step 3: Scrutiny and Approval Process

Once your form is submitted, your application will go through BoK’s scrutiny process:

- Screening & Assessment: BoK assesses all applications to ensure your application complies with eligibility criteria. This includes evaluating the feasibility of the business proposal and the potential for job creation.

Tip

Make sure your business idea has an angle of job creation/ employment opportunities.

- Proposal Evaluation: the proposals that demonstrate a solid business plan, financial viability, and growth potential will be prioritized.

- Response Timeline: BoK commits to a 30-day processing time from the submission of the application, given that all required documents are provided.

Step 4: Approval and Next Steps

If your application is accepted, here’s what you can expect:

- Training Session: Before the loan is disbursed, approved applicants will receive training on essential business and financial management skills. This training is mandatory to ensure business success.

- Loan Disbursement: Loans ranging from PKR 1 million to 5 million will be disbursed within a month of approval. The loan tenure is up to 8 years with a 20-month grace period where no repayments are required.

- Business Registration Check: BoK will verify the legal registration of your business as a final check before disbursing funds. So make sure you are clear and transparent with the business registration process to avoid any hindrances or delays.

Step 5: Grievance Redressal (For Rejected Applications)

If your application is rejected, you have the option to appeal through the Grievance Redressal Committee. Here is how you can do that:

Applicants can file a complaint if they believe the rejection was unjustified. This is called submitting your grievances. The committee will then review and respond to grievances. If your appeal is accepted, you may be allowed to reapply.

Additional Information about the Loan Terms and Security

Here’s what you should keep in mind of the loan terms and security requirements before applying:

- Loan Type: the loan is with no mark-up (interest-free). But it has to be repaid.

- Debt-to-Equity Ratio: 90:10 (meaning applicants should have 10% equity contribution, which can include existing assets or cash).

- Security Requirements: Each partner must provide a personal guarantee. The business entity must also offer a corporate guarantee.

- Monitoring: The project’s steering committee will monitor the program quarterly to track loan utilization and ensure successful business outcomes.

- Bigger loans: bok is for greater loans ranging from PKR 1 million to 5 million. So, make you have a solid business plan to utilize the funds to its greatest extent.

Targeted Sectors for Loan Approval

BoK encourages applications from the following high-potential sectors, with a special focus on innovative, tech-driven, and community-serving businesses:

- Information Technology and AI

- Agriculture (non-farming businesses like value chains)

- Healthcare & Biotechnology

- Education Sector

- Green Energy

- Media, Photography, and Entertainment

- Tourism and Hospitality

The businesses within these sectors that can demonstrate viability, sustainability, and job-creation potential have higher chances of approval.

Note: Businesses on negative list of Government of Pakistan that includes Arms and Ammunition, Explosives, Radioactive substances, Security printing, Alcoholic beverages, and Liquor will not be encouraged.

Final Tips for a Successful Application

- Prepare a Clear Business Plan: you should focus more on outlining your business’ value, target market, and competitive advantage.

- Choose Reliable Partners: Your team should include 3-5 skilled partners committed to the business’s success.

- Showcase Economic Impact: Highlight how your business will contribute to Khyber Pakhtunkhwa’s economy by creating employment opportunities and supporting local growth.

Conclusion

The Ehsaas Naujawan Programme through Bank of Khyber offers a transformative opportunity for young entrepreneurs in Khyber Pakhtunkhwa to secure interest-free loans and drive sustainable economic development. By following these steps and meeting the eligibility criteria, you can be on your way to securing funding for your business.

So, what are you waiting for? Start your journey today on the BoK online portal and turn your entrepreneurial vision into reality! This article on how to apply may have clarified all your queries. Go to FAQs section and learn on How to apply?

For more information on eligibility and application tips, visit the official Bank of Khyber portal.