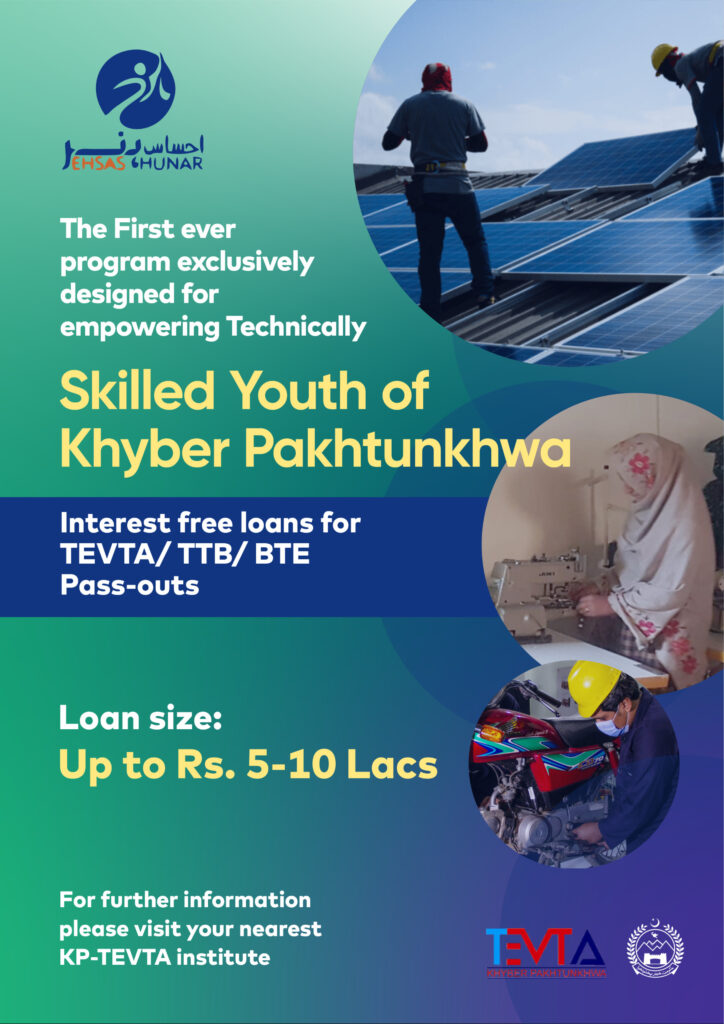

Ehsaas Hunar Loan Scheme 2026 – Apply Online for Interest-Free Loan up to 5 Lakh in Khyber Pakhtunkhwa

The Ehsaas Hunar Loan Scheme is a flagship initiative by the Government of Khyber Pakhtunkhwa, TEVTA KP, and Bank of Khyber (BOK) to empower skilled youth, women, and professionals by providing interest-free business loans.

This program is specially designed for individuals who possess technical or vocational skills and want to start or expand their own business.

If you belong to Khyber Pakhtunkhwa and are looking for easy, interest-free financial support, this scheme is a golden opportunity.

Overview of Ehsaas Hunar Loan Scheme

Ehsaas Hunar Loan Amount & Duration

This loan can be used for small businesses, startups, tools, machinery, or service-based work.

💰 Loan Amount

Up to Rs. 500,000

- Interest-Free (0% Markup)

- Government-backed financing

- For skilled youth & entrepreneurs

⏳ Loan Duration

Up to 3 Years

- Easy monthly installments

- Flexible repayment schedule

- Grace period as per bank policy

Benefits of Ehsaas Hunar Loan Scheme

Benefits of Ehsaas Hunar Loan Scheme

Eligibility Criteria – Ehsaas Hunar Loan Scheme

To apply for the Ehsaas Hunar Loan Scheme, applicants must meet the following requirements:

- Age between 18 to 40 years

- Permanent resident of Khyber Pakhtunkhwa

- Must possess technical or vocational skills

- TEVTA-certified or certified from a recognized institute

- Applicant should be unemployed or self-employed

- Must have a viable business idea

- Should not be a bank defaulter

- Valid CNIC and active mobile number required

Who Can Apply for Ehsaas Hunar Loan Scheme?

This scheme is specially designed for skilled individuals and entrepreneurs working in the following fields:

Technical Trades

Handicrafts

IT & Freelancing

Tailoring & Embroidery

Electrical / Mechanical Work

Small Manufacturing Units

Home-Based Businesses

Quota Distribution

75%

General Skilled Applicants

15%

Women Applicants

10%

Special Categories

Disabled • Transgender • MinoritiesRequired Documents

How to Apply for Ehsaas Hunar Loan ?

Contact Information

091-111-265-265

www.bok.com.pk

FAQs

The Ehsaas Hunar Loan Scheme is an initiative by the Government of Khyber Pakhtunkhwa to provide interest-free financial support to skilled youth and entrepreneurs who want to start or grow their business. :contentReference[oaicite:1]{index=1}

Applicants must be residents of Khyber Pakhtunkhwa, aged 18-40, possess vocational or technical skills, and have a viable business idea. Women and special category applicants are also given quotas. :contentReference[oaicite:2]{index=2}

Under the scheme, loans of up to Rs. 500,000 can be disbursed interest-free for eligible individuals to start or expand businesses. :contentReference[oaicite:3]{index=3}

No — this loan is provided on an interest-free basis to reduce financial burden and encourage self-employment. :contentReference[oaicite:4]{index=4}

The approval and disbursement time depends on the verification process, but typically it takes a few weeks after the submission of complete documents. :contentReference[oaicite:5]{index=5}

Yes — the scheme includes quotas and priority segments for female applicants and special categories to ensure inclusive participation. :contentReference[oaicite:6]{index=6}